Unpaid Utility Bills: Who Pays, Landlord or Tenant?

A common concern amongst landlords is what happens if a tenant moves out leaving unpaid utility bills. Whether it falls to the landlord to settle the debts, or it remains the responsibility of the tenant, is precisely what we are setting out to provide clarity on in this post.

A common concern amongst landlords is what happens if a tenant moves out leaving unpaid utility bills. Whether it falls to the landlord to settle the debts, or it remains the responsibility of the tenant, is precisely what we are setting out to provide clarity on in this post.

Is it a landlord’s responsibility to settle unpaid utility bills when a tenant moves out?

Generally, the answer to this question is no. If the tenant’s name is on the bill, and the tenancy agreement states that the tenants are responsible for paying the utility bills directly, then you will not be liable as a landlord for any unpaid bills they leave behind once the tenancy is over.

However, you will need to take care to ensure you are protected should such a situation arise. Here are some important steps to follow:

- Always inform the local council when you have a new tenant move in. Provide them with the names of the tenants, and the contact details of the previous tenants.

- Let the gas, electricity and water suppliers know of the change in tenancy.

- Encourage your tenants to change the names on the utility bills as soon as possible.

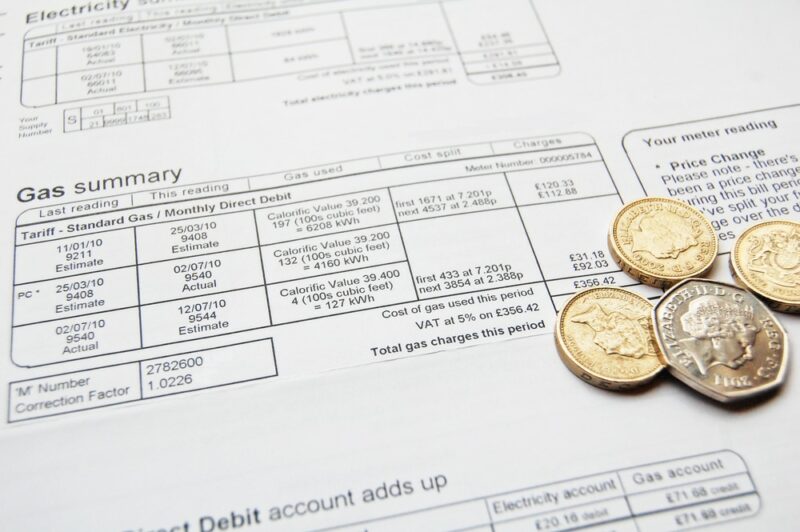

- Take meter readings at the start and end of each tenancy. Your check-in and check-out reports should document the readings.

- Make sure that your tenancy agreement clearly sets out that utility payments are to be made directly by the tenant, and ensure the agreement is signed by the tenants.

What bills are tenants responsible for paying?

The bills your tenants are responsible for paying should be detailed in the tenancy agreement. Generally, these will be gas, electricity, water, council tax, telephone and internet. However, this may not always be the case.

When utilities are registered in the tenant’s name, the tenant is responsible for covering them from the date they move in. They will not, however, be responsible for any debts left by the previous tenants. This is why it is important to take meter readings as soon as a tenant moves out, and to let your tenants know to take the readings when they move in, and provide them to the utility companies.

Whatever way, if the utilities are registered in the tenant’s name, landlords are not required to settle any outstanding payments once a tenant has moved out. It is down to the utility company to chase the relevant tenant themselves.

Sometimes, however, landlords choose to register the utilities in their name, and charge the costs on. This is generally the method of choice for shorter lets where it can be a lot of hassle to keep changing the name on the utility providers’ records. The downside to this though is that if the tenant leaves without paying, you as the landlord may be responsible for settling the debts.

Dealing with utility bills at end of tenancy

Most utility suppliers will need a few days’ notice ahead of the end of the tenancy. If the bills are in the name of the tenant, this will be their responsibility to organise.

If there are bills left unpaid, and the utilities are in your name as the landlord, or the tenant failed to register directly with the utility companies, then you will need to take steps to prove that the tenants were living at the property during the billing period that’s in question. This can usually be done by providing a copy of the tenancy agreement, although individual utility providers will have their own requirements.

Who covers the utility bills during void periods?

When your property is untenanted, you as the owner will be responsible for covering the utility bills. Providing you keep energy usage down to a minimum, you should only be paying basic charges. It is important however to keep the property heated during the colder months so as to avoid damp and the risk of frozen pipes.

It is a good idea to organise regular inspections of your property if it’s left empty for a while so that any potential issues can be dealt with. Plus be sure to let your insurer know, as you will need special cover for extended vacant periods.

Homes2let offers a property management service that reduces the landlord burden, with an added benefit…

As a landlord, you have enough to deal with without having deal with deposit claims. So why not hand over to a property management service, but one with a clear added benefit?

The homes2let guaranteed rent scheme guarantees rental payments, even when the property is untenanted, as well as taking all the hassle of property management off your shoulders too.

Interested to discover more? You are welcome to get in touch with our expert team to discover how we can make your life as a landlord more of a breeze.

Riz is the founder of homes2let and has been in real estate for over twenty years. He has a background in economics and is a real estate developer and buy to let investor.

Free, no obligation 15min call with Riz – Book Now

Related Insights

Can a Tenant Run a Business from a Rental Property?

With so many people now working from home due to the COVID-19 pandemic, this does of course raise the question for landlords as to whether tenants should be allowed to start running a business from a rented property. Let’s take a look at what the law says, and the important considerations every landlord needs to make when considering allowing tenants to use their home as a place of business.

October 2023 Croydon Property Market Snapshot

New data has unveiled a 2.8% annual depreciation in Croydon house prices, slicing £11,500 off the typical home's value (House Price Index, August 2023).

Right to Rent Checks Now Mandatory for ALL New Tenants

From 1 July 2021, all landlords must check the immigration status of prospective tenants, no matter their nationality. Citizens of the European Economic Area (EEA) and members of their families must now hold an immigration status in the UK, just the same as any foreign national. Whilst an EEA passport or national ID card was previously adequate to prove a right to rent, these can no longer be relied upon.