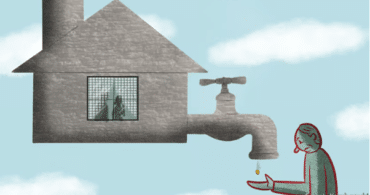

Landlords Face Tough Choices as EPC Deadline Looms

A new survey reveals that most landlords are aware of upcoming Energy Performance Certificate (EPC) regulations, but many are unprepared. Over two-thirds of landlords own properties that don’t meet the new ‘C’ target, raising questions about how they will adapt. Will they invest in upgrades, pass the costs on to tenants, or simply sell up? Read on to discover the challenges and opportunities facing landlords in the face of these new rules…

Estimated reading time: 3 minutes

Last updated: Thursday 21st November 13:04

A recent survey by Foundation Home Loans has revealed that over two-thirds of private landlords own properties that fall short of the new Energy Performance Certificate (EPC) ‘C’ target. While awareness of the new standards is high, a significant number of landlords are still unclear on the details.

Key Findings:

- EPC Knowledge Gap: Although 92% of landlords are aware of the new EPC requirements, only 67% fully understand them. Portfolio landlords, those with four or more buy-to-let mortgages, show a slightly lower level of understanding.

- Improvement Plans: 42% of landlords plan to make the necessary upgrades to meet the EPC ‘C’ standard. However, a significant proportion (34%) intend to sell their non-compliant properties without making any improvements.

- Funding the Upgrades: Landlords plan to fund the upgrades through a variety of means, including savings, rent increases, grants, equity release, and loans.

Challenges and Opportunities

The survey highlights the challenges landlords face in meeting the new EPC requirements, including the costs involved and the need for clear guidance. It also underscores the role lenders and intermediaries can play in supporting landlords through green mortgage products and tailored advice.

The Bottom Line

The clock is ticking for landlords to ensure their properties meet the new EPC standards. Those who fail to comply risk facing penalties or being unable to let their properties. By taking proactive steps to understand the requirements and explore financing options, landlords can future-proof their investments and contribute to a more sustainable rental sector.

Check out this YouTube video on how to get an EPC rating of C:

Homes2let offers a property management service that reduces the landlord burden, with an added benefit…

As a landlord, you have enough to deal with without having deal with deposit claims. So why not hand over to a property management service, but one with a clear added benefit?

The homes2let guaranteed rent scheme guarantees rental payments, even when the property is untenanted, as well as taking all the hassle of property management off your shoulders too.

Interested to discover more? You are welcome to get in touch with our expert team to discover how we can make your life as a landlord more of a breeze.

Related Insights

6 Ways to Maximise Rental Yield

Capital appreciation and rental yield dictate success as a property investor, and form a vital factor for lenders when making a decision about affordability for a buy-to-let mortgage. If you are investing with a view to long term gains through letting, you will want to look closely at how you can maximise your rental yield. Read on as we share our top tips on how this can be achieved.

The Shift in the UK Buy-to-Let Market: Navigating Landlords’ Sales Surge and Rising Rents

The UK real estate landscape is witnessing a significant transformation, particularly evident in the buy-to-let sector. The recent trend of landlords divesting their properties is reshaping the rental market across Great Britain, with a notable impact in Scotland. This article delves into the multifaceted reasons behind this shift, the consequent effects on the housing market, and the future outlook for investors and tenants alike.

Attracting Millennials to Your Rental Apartment – Our Guide

If you are a landlord with property to let in London, millennials could well be an ideal audience for you. Here are our top tips to help you attract this demographic to your rental apartment.