Insights - Industry comment

Loophole Means Section 21 Ban Delay “is Not What it Seems” – Claim

Goodlord’s Oli Sherlock argues the government’s delay on the Section 21 eviction ban is misleading. Despite assurances, some landlords may still serve Section 21 notices. Learn about the potential loopholes.

Read More

Buy-to-Let in Croydon: Potential Rate Cuts later in 2024 and Why Croydon Remains a Strong Investment

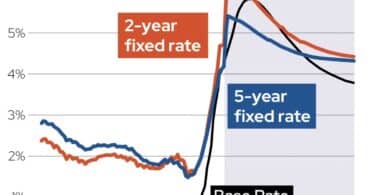

The Bank of England’s recent decision to hold interest rates at 5.25% has injected some uncertainty into the UK housing market. While the pause offers a temporary reprieve from rising borrowing costs, the impact of previous rate hikes is likely to be felt in the coming months, potentially leading to slower house price growth. However, Governor Andrew Bailey’s comments suggest a possible shift towards lower rates in the near future, which could reignite buyer demand and stabilize prices.

Despite this uncertainty, Croydon remains a compelling location for buy-to-let investors seeking a steady return on their investment. Its affordability, ongoing regeneration, excellent transport links, and vibrant atmosphere make it an attractive proposition for tenants, particularly in a market where affordability is a key concern.

New Rules for Landlords on Smoke and Carbon Monoxide Alarms

Private and social landlords are set to face tougher new rules, making it a legal requirement to fit smoke alarms in all types of rented accommodation, regardless of tenure. The conditions under which they must be fitted will also be widened. Read on for an update on the latest landlord smoke alarm requirements for the UK.

UK House Prices Witness a Decline in March: Insights from the Latest Halifax Report

Explore the latest insights on the UK housing market downturn in March, with detailed analysis from the Halifax report, implications for homeowners and buyers, and future outlook. Uncover the key factors driving house prices and regional variations in this comprehensive guide.

Croydon: The Best Value Borough for Property Investment in 2024

Croydon’s excellent connectivity and transportation infrastructure significantly bolster its attractiveness as a prime location for property investment in 2024.

The borough’s strategic position, offering a mere 15-minute journey to central London and Gatwick Airport, adds immense value to its real estate market.

Furthermore, the comprehensive local tram and rail network in Croydon enhances the ease of movement within the area, making it an even more desirable destination for investors.

UK Housing Market 2024: Predicted Growth and Key Economic Factors

The UK housing market is set to rebound in 2024, with a projected 5% rise in house prices, buoyed by declining mortgage rates and potential Bank of England interest rate cuts.

Improved economic conditions and housing affordability are expected to stimulate market growth, despite previous predictions of a downturn.

Stability in the economy, especially in employment, will further support the housing market, maintaining property values and reducing the likelihood of forced sales.

The Surprising Stability of UK House Prices in 2023

In 2023, house prices defied expectations by showing remarkable resilience, contrary to predictions of a crash. Key factors like a strong labor market and responsible lending policies played a significant role in maintaining market stability. The housing market’s robust performance indicates a low likelihood of a crash in 2024, mirroring the trends observed this year.

The Shift in the UK Buy-to-Let Market: Navigating Landlords’ Sales Surge and Rising Rents

The UK real estate landscape is witnessing a significant transformation, particularly evident in the buy-to-let sector. The recent trend of landlords divesting their properties is reshaping the rental market across Great Britain, with a notable impact in Scotland.

This article delves into the multifaceted reasons behind this shift, the consequent effects on the housing market, and the future outlook for investors and tenants alike.

Surge in Rent Arrears Sparks Call for Landlords to Protect Their Investments

UK landlords are being prompted to make sure they have appropriate strategies in place to protect their property investments following a recent surge in rent arrear cases. With government data revealing that rent arrears amongst private tenants have increased, and almost two thirds of landlords reporting that they’ve had to absorb arrears-related losses from their savings, it is vital that some form of landlord rent arrears insurance is in place to mitigate future financial issues.

What the Delay to Making Tax Digital Means for Landlords

Originally due to be introduced in April 2023, HMRC Making Tax Digital for Income Tax has now been pushed back to April 2024. What this means for taxpayers and, in particular landlords, is the subject of this latest post.