Insights - Landlords

Buy to Let Landlords: How to Deal With a Short Lease Property

Are you looking for a leasehold property to buy to let? If so, you may have considered buying a property with a short lease. But is short lease property for sale actually worth the risk? What are the main considerations? Is it possible to obtain finance, and what exactly is a short lease anyway? Join us as we explore the pros and cons of buying a short lease property.

Read More

How to Make a Successful Tenancy Deposit Scheme Claim

Of the 29,697 tenancy deposit scheme cases that came to dispute in 2020/21, 75 per cent were initiated by the tenant. Comparing this to just 17 per cent having been initiated by a letting agent, and 8 per cent by a landlord, it’s clear to see that it’s important for landlords to be prepared and aware of best practices should they find themselves in a deposit protection scheme dispute.

Navigating Tenant Rights in the Face of Rent Increases

In the current rental market, tenants face rising costs due to inflation (higher landlords costs) and high demand, with specific legal protections depending on their tenancy type. Tenants can negotiate with landlords or legally challenge unjust rent increases, particularly through tribunals that assess the fairness of the proposed rent in relation to local market rates. Understanding their rights and the specifics of their rental agreements is key for tenants to navigate these increases effectively.

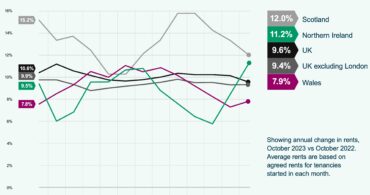

The Shift in the UK Buy-to-Let Market: Navigating Landlords’ Sales Surge and Rising Rents

The UK real estate landscape is witnessing a significant transformation, particularly evident in the buy-to-let sector. The recent trend of landlords divesting their properties is reshaping the rental market across Great Britain, with a notable impact in Scotland.

This article delves into the multifaceted reasons behind this shift, the consequent effects on the housing market, and the future outlook for investors and tenants alike.

EPC Revisions: Unravelling Implications for Homeowners and Landlords

The Aftermath of EPC Shifts in Property Market

The recent modification in energy efficiency standards by Rishi Sunak may lead the property sector to uncharted waters unless a clearer perspective emerges. Buy-To-Let landlords, who own multiple properties find themselves at a crossroads due to these changes.

October 2023 Croydon Property Market Snapshot

New data has unveiled a 2.8% annual depreciation in Croydon house prices, slicing £11,500 off the typical home’s value (House Price Index, August 2023).

The Biggest Change In Renters’ Law In A Generation

The new Renters Reform Bill changes the balance of power in favour of tenants, because it will increase their security and peace of mind. The new law could make it difficult and costly for landlords to evict tenants or sell their properties.

The Top 5 Most Common Landlord Insurance Claims

The importance of specialist landlord insurance cannot be over-emphasised. With the risks higher for rental property than everyday residential property, the financial repercussions of not having adequate cover in place can be considerable. To help landlords plan to reduce risk, we look at the top five biggest risks posed to landlords, which inevitably result in landlord insurance claims.

Updated Advice for Landlords on Right to Rent Checks 2022

Right to Rent checks are set to face reforms at the start of the new tax year on 6th April 2022, with 5th April marking the end of the COVID-related temporary adjustments which allowed checks to be carried out virtually. From 6th April onwards, there will be a new permanent online solution which will allow right to rent checks to continue to be carried out remotely, for all nationalities, and with enhanced security.

Surge in Rent Arrears Sparks Call for Landlords to Protect Their Investments

UK landlords are being prompted to make sure they have appropriate strategies in place to protect their property investments following a recent surge in rent arrear cases. With government data revealing that rent arrears amongst private tenants have increased, and almost two thirds of landlords reporting that they’ve had to absorb arrears-related losses from their savings, it is vital that some form of landlord rent arrears insurance is in place to mitigate future financial issues.