Insights

The Ultimate Guide to Guaranteed Rent for Landlords: Maximising Security and Profitability

Discover the essentials of guaranteed rent for landlords in our concise guide. Learn about its advantages, risks, and financial impacts to enhance your rental property strategy.

Read More

Croydon: The Best Value Borough for Property Investment in 2024

Croydon’s excellent connectivity and transportation infrastructure significantly bolster its attractiveness as a prime location for property investment in 2024.

The borough’s strategic position, offering a mere 15-minute journey to central London and Gatwick Airport, adds immense value to its real estate market.

Furthermore, the comprehensive local tram and rail network in Croydon enhances the ease of movement within the area, making it an even more desirable destination for investors.

UK Housing Market 2024: Predicted Growth and Key Economic Factors

The UK housing market is set to rebound in 2024, with a projected 5% rise in house prices, buoyed by declining mortgage rates and potential Bank of England interest rate cuts.

Improved economic conditions and housing affordability are expected to stimulate market growth, despite previous predictions of a downturn.

Stability in the economy, especially in employment, will further support the housing market, maintaining property values and reducing the likelihood of forced sales.

The Surprising Stability of UK House Prices in 2023

In 2023, house prices defied expectations by showing remarkable resilience, contrary to predictions of a crash. Key factors like a strong labor market and responsible lending policies played a significant role in maintaining market stability. The housing market’s robust performance indicates a low likelihood of a crash in 2024, mirroring the trends observed this year.

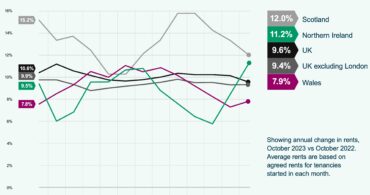

Navigating Tenant Rights in the Face of Rent Increases

In the current rental market, tenants face rising costs due to inflation (higher landlords costs) and high demand, with specific legal protections depending on their tenancy type. Tenants can negotiate with landlords or legally challenge unjust rent increases, particularly through tribunals that assess the fairness of the proposed rent in relation to local market rates. Understanding their rights and the specifics of their rental agreements is key for tenants to navigate these increases effectively.

The Shift in the UK Buy-to-Let Market: Navigating Landlords’ Sales Surge and Rising Rents

The UK real estate landscape is witnessing a significant transformation, particularly evident in the buy-to-let sector. The recent trend of landlords divesting their properties is reshaping the rental market across Great Britain, with a notable impact in Scotland.

This article delves into the multifaceted reasons behind this shift, the consequent effects on the housing market, and the future outlook for investors and tenants alike.

EPC Revisions: Unravelling Implications for Homeowners and Landlords

The Aftermath of EPC Shifts in Property Market

The recent modification in energy efficiency standards by Rishi Sunak may lead the property sector to uncharted waters unless a clearer perspective emerges. Buy-To-Let landlords, who own multiple properties find themselves at a crossroads due to these changes.

October 2023 Croydon Property Market Snapshot

New data has unveiled a 2.8% annual depreciation in Croydon house prices, slicing £11,500 off the typical home’s value (House Price Index, August 2023).

Navigating the Current Landscape of Buy-to-Let Mortgage Rates

Read our detailed mortgage update for landlords on how to navigate the changing landscape of buy-to-let mortgage rates. We highlight the recent surge to an average of 6.54% from last year’s 4.67%. Influenced by the Bank of England’s base rate hikes, the elevated rates emphasize the importance of considering overall mortgage costs.

Learn to closely monitor economic indicators, government policies, and lending market trends, and to conduct comprehensive research and seek expert consultation to make informed investment choices.

Amidst the market uncertainty discover the homes2let guaranteed rent scheme for hassle-free property management and secured rental payments.

The Pros and Cons of Fixing Mortgage Products for Buy-To-Let Investors

Fixing your mortgage interest rate can provide financial stability and predictability, it can also limit your flexibility as a buy-to-let landlord. It is important to weigh up the pros and cons and consider your personal circumstances before making a final decision. Seeking professional advice can help you make an informed choice about what is best for you and your portfolio.