EPC Revisions: Unravelling Implications for Homeowners and Landlords

The Aftermath of EPC Shifts in Property Market

The recent modification in energy efficiency standards by Rishi Sunak may lead the property sector to uncharted waters unless a clearer perspective emerges. Buy-To-Let landlords, who own multiple properties find themselves at a crossroads due to these changes.

Deciphering the EPC Maze

The Energy Performance Certificate (EPC) system, although aimed at promoting eco-friendly housing, often presents varied results for similar properties. There may even be inconsistencies in EPC ratings for houses on the same street, revealing gaps in the assessment process. The fluctuating criteria only adds to the confusion.

The Price of Going Green

Considering the looming EPC requirements, landlords face the dilemma of investing in upgrades or offloading properties. With housing values below £100,000 and potential eco-improvement costs reaching up to £10,000, the return on investment for landlords, especially in lower-value areas, is challenging.

Tenant Dynamics

Amidst EPC Upheaval long-term tenants may see rental increments as landlords grapple with the costs of energy-efficient renovations. Yet, despite Sunak’s intervention, a majority of landlords seemed ready for the EPC shift.

Charting the Progress

Recent data showcases commendable advancements. Savills reveals a drop in homes rated below EPC C in recent years. Furthermore, the government’s push towards greener heating alternatives and extended bans on non-eco-friendly heating systems signals a commitment to a greener future.

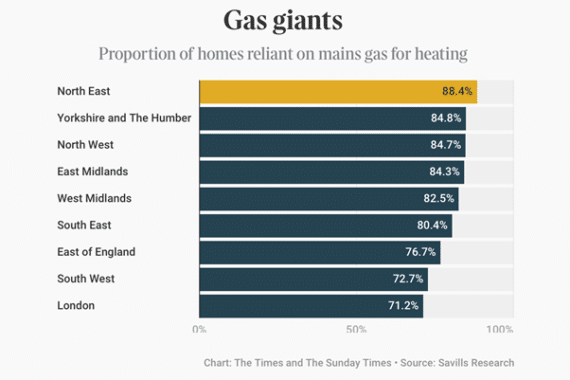

Decoding Housing’s Carbon Footprint

Accounting for more than 20% of carbon emissions, housing is at the forefront of the green revolution. A considerable chunk of emissions stems from heating, placing the focus on boilers, particularly gas ones.

A Look into EPC Distribution

The age of properties plays a pivotal role in their energy efficiency. Modern regulations ensure new builds predominantly have A or B EPC ratings. However, older houses, especially outside southern England, still lag, emphasising the need for renovations.

The Investment in Energy Efficiency

Elevating a property’s EPC grade demands substantial investment. While the motivation for green upgrades is clear, the financial feasibility remains questionable. Dan Jestico from Savills suggests that merely replacing boilers with heat pumps isn’t the solution. Comprehensive infrastructural changes are essential.

Market Response to Green Regulations

Eco-friendliness remains a priority for many tenants, according to Boutaina Cansick from Johns & Co. This preference is reflected in property prices, with A-rated homes fetching significantly higher prices.

Challenges for Heritage Properties

Historical properties, especially those listed, grapple with unique challenges. The balance between maintaining heritage and ensuring energy efficiency is delicate. Geoffrey Lazell, residing in a listed property, voices concerns about the feasibility of green upgrades for such homes.

Calls for Clarity and Incentives

Amidst the eco-shift, the need for clarity stands out. Financial incentives like VAT relief and stamp duty rebates for green upgrades could motivate homeowners. Ben Beadle from the National Residential Landlords Association highlights the necessity of a clear path for landlords to plan effectively.

While the direction towards a greener housing landscape is evident, the journey is laden with complexities. A well-defined roadmap, coupled with financial incentives, can make the transition smoother for all stakeholders.

Homes2let offers a property management service that reduces the landlord burden, with an added benefit…

As a landlord, you have enough to deal with without having deal with deposit claims. So why not hand over to a property management service, but one with a clear added benefit?

The homes2let guaranteed rent scheme guarantees rental payments, even when the property is untenanted, as well as taking all the hassle of property management off your shoulders too.

Interested to discover more? You are welcome to get in touch with our expert team to discover how we can make your life as a landlord more of a breeze.

Get in Touch

Riz is the founder of homes2let and has been in real estate for over twenty years. He has a background in economics and is a real estate developer and buy to let investor.

Free, no obligation 15min call with Riz – Book Now

Related Insights

A Landlord’s Solution to Preventing Duplicate Keys

One of the most worrying issues for landlords has to be unauthorised key duplication. It can be a significant security risk, not just for the property owner, but also for inbound tenants. Thankfully there is a solution. Registered key systems prevent duplicates being made without an authorised signature. Let’s take a look at how they work, and how this security measure can provide peace of mind for landlords.

The Lowdown on Pet Friendly Tenancies

There has been much discussion recently on the subject of pet friendly tenancies, with campaigners on the case and various initiatives in the pipeline. But there is also confusion, with developments having prompted the assumption that landlords are now legally obliged to accept pets. How much truth there is in this notion, and where the whole situation is up to, is something we’ll explore in this post.

Right to Rent Checks Now Mandatory for ALL New Tenants

From 1 July 2021, all landlords must check the immigration status of prospective tenants, no matter their nationality. Citizens of the European Economic Area (EEA) and members of their families must now hold an immigration status in the UK, just the same as any foreign national. Whilst an EEA passport or national ID card was previously adequate to prove a right to rent, these can no longer be relied upon.