Buy-to-Let in Croydon: Potential Rate Cuts later in 2024 and Why Croydon Remains a Strong Investment

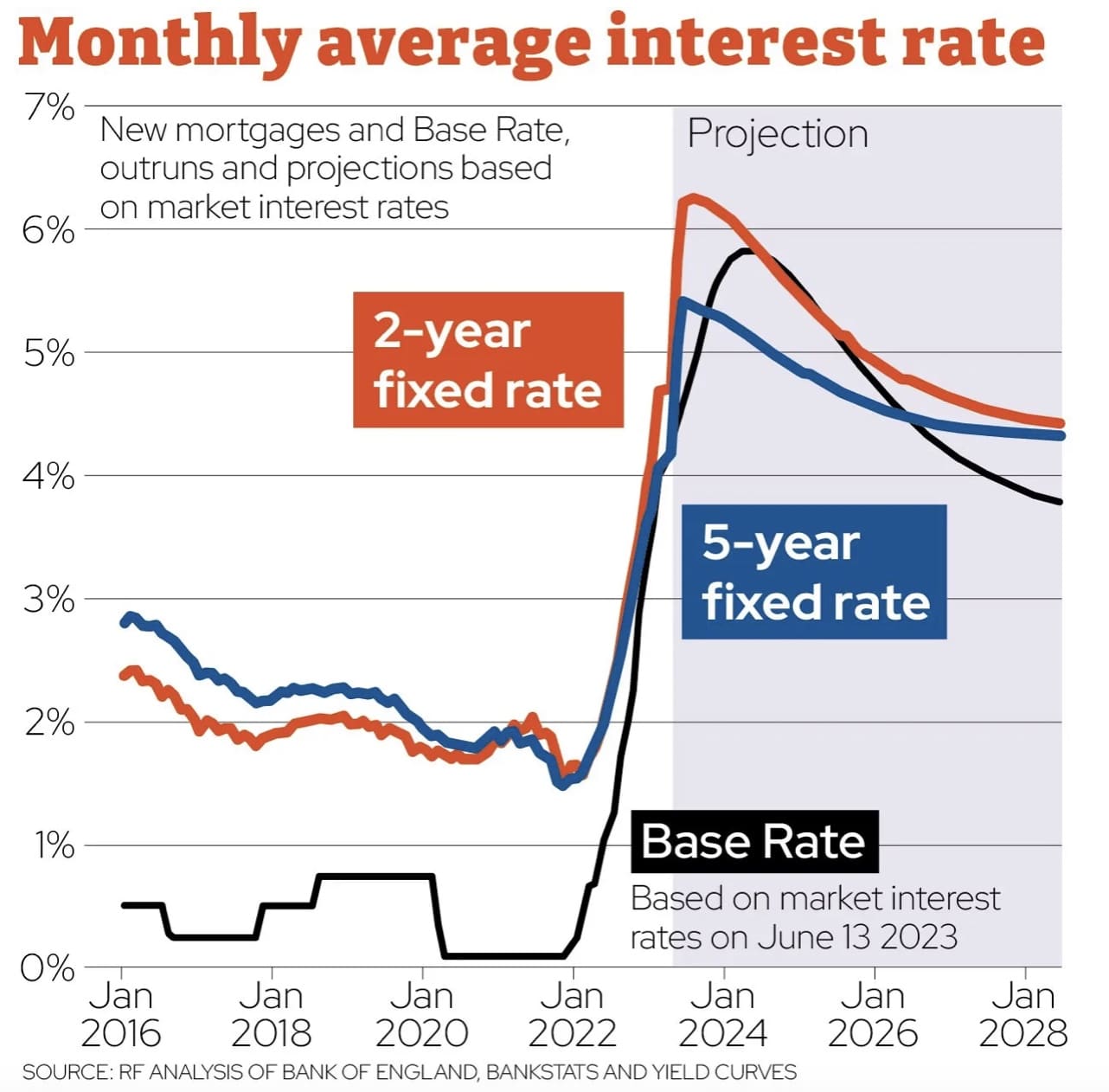

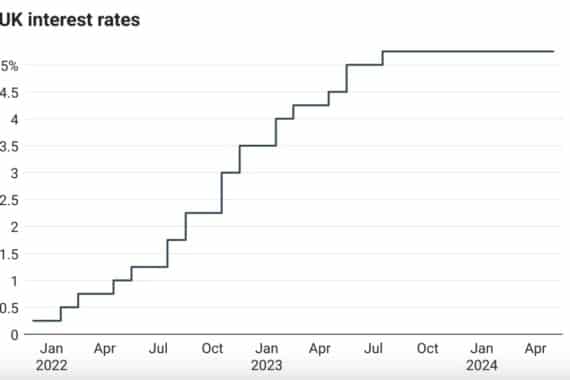

The Bank of England’s recent decision to hold interest rates at 5.25% has injected some uncertainty into the UK housing market. While the pause offers a temporary reprieve from rising borrowing costs, the impact of previous rate hikes is likely to be felt in the coming months, potentially leading to slower house price growth. However, Governor Andrew Bailey’s comments suggest a possible shift towards lower rates in the near future, which could reignite buyer demand and stabilize prices.

Despite this uncertainty, Croydon remains a compelling location for buy-to-let investors seeking a steady return on their investment. Its affordability, ongoing regeneration, excellent transport links, and vibrant atmosphere make it an attractive proposition for tenants, particularly in a market where affordability is a key concern.

Buy-to-Let in London: Potential Rate Cuts and Why Croydon Remains a Strong Investment

Interest Rates on Hold, But Housing Market Impact Still Looms

The Bank of England held interest rates at a 16-year high of 5.25% but signaled a possible cut soon. Despite a 7-2 vote to maintain rates, some members argued for a reduction due to falling inflation.

The Bank will consider upcoming economic data, particularly inflation figures, before potentially lowering rates in June or August. This could provide relief to homeowners and boost the housing market.

Potential Impact of Recent Rate Increases

- Slower House Price Growth: With borrowing costs rising, potential buyers may be more cautious, leading to a slowdown in house price growth compared to the previous year.

- Fewer Cash Buyers: The higher cost of borrowing may also lead to a decrease in the number of cash buyers. This could potentially put downward pressure on prices, particularly in areas heavily reliant on cash purchases.

- Increased Scrutiny from Lenders: Lenders are likely to become more stringent with mortgage applications due to the higher risk environment. This could make it more challenging for some buyers to secure financing, further dampening demand.

A Potential Shift Towards Lower Rates?

However, the recent hold on rates and comments from Bank of England Governor Andrew Bailey suggest a potential shift towards lower borrowing costs in the near future. Here’s how this could impact the housing market:

- Stimulated Demand: A reduction in interest rates would make mortgages more affordable, potentially reigniting buyer interest and leading to a pick-up in demand. This could help to stabilize or even increase house prices in some areas.

- Increased Competition: Lower rates could also attract more first-time buyers to the market, leading to increased competition for properties. This could benefit sellers in certain locations.

- Uncertainty Remains: While a rate cut is a possibility, the Bank of England has emphasized the need for further evidence that inflation is under control before lowering borrowing costs. This uncertainty may lead some buyers and sellers to adopt a wait-and-see approach.

It’s important to note that the housing market is complex and influenced by various factors beyond interest rates.These include economic conditions, wage growth, consumer confidence, and the availability of properties on the market.

Why Consider Croydon for Buy-to-Let Investment?

Despite the potential cooling effect of recent rate increases and the uncertainty surrounding future rate cuts, Croydon remains an attractive proposition for buy-to-let investors for several reasons:

Affordability: Compared to central London, Croydon offers relatively affordable properties, making it easier to get onto the property ladder and potentially achieve higher rental yields.

Regeneration on the Rise: Croydon is undergoing significant regeneration, with new infrastructure projects, businesses,and residential developments. This investment is expected to boost the area’s appeal and potentially lead to property price appreciation in the long term.

Excellent Transport Links: Croydon boasts excellent transport connections, including direct trains to central London,Gatwick Airport, and other major towns. This makes it a convenient location for tenants who work or commute within the city. Croydon is well-connected by tram services, providing easy access to surrounding areas. Additionally, both Gatwick and Heathrow airports are within easy reach via excellent transport links.

Thriving Shopping Scene: Croydon offers a vibrant shopping scene, with major shopping centers like the Centrale and Whitgift Centre attracting residents and visitors. This can contribute to the overall desirability of the area for tenants. The abundance of shops, restaurants, and leisure facilities makes Croydon a vibrant and attractive place to live.

Up-and-Coming Cultural Hub: Croydon is transforming into a cultural hub, with numerous art galleries, theaters, and music venues springing up. This adds to the area’s character and makes it a more attractive proposition for young professionals and families.

Strong Rental Market: Croydon has a healthy rental market, with high tenant demand due to its affordability and proximity to London. This ensures a steady stream of rental income for buy-to-let investors.

Conclusion

The Bank of England’s decision to hold interest rates may provide some temporary stability to the housing market.However, the recent increases are likely to dampen house price growth in the coming months. Despite this, Croydon presents a compelling buy-to-let opportunity due to its affordability, regeneration potential, excellent transport links,thriving shopping scene, and up-and-coming cultural scene.

Croydon offers a strong rental market, making it an attractive option for investors seeking a steady return on their investment, even in a changing market environment, with the potential for upside depending on the future direction of interest rates.

Homes2let offers a property management service that reduces the landlord burden, with an added benefit…

As a landlord, you have enough to deal with without having deal with deposit claims. So why not hand over to a property management service, but one with a clear added benefit?

The homes2let guaranteed rent scheme guarantees rental payments, even when the property is untenanted, as well as taking all the hassle of property management off your shoulders too.

Top 5 FAQs

How will recent interest rate hikes affect the housing market?

Recent interest rate hikes may lead to slower house price growth, fewer cash buyers, and stricter lending criteria.

Could interest rates be cut in the near future?

The Bank of England has signaled a potential for lower borrowing costs if inflation continues to fall. This could stimulate buyer demand and stabilize house prices.

Why is Croydon a good location for buy-to-let investment?

Croydon offers affordability compared to central London, is undergoing significant regeneration, boasts excellent transport links, and has a thriving shopping and cultural scene. These factors contribute to a strong rental market.

What are some of the risks associated with buy-to-let investment?

Risks include changes in rental yields, property vacancy periods, unexpected maintenance costs, and potential future interest rate rises.

What factors should I consider before becoming a buy-to-let investor?

It’s crucial to research the local rental market, understand the ongoing costs of property ownership, secure appropriate buy-to-let financing, and be prepared for the responsibilities of being a landlord.

Related Insights

An In-Depth Explanation of Guaranteed Rent Schemes for Buy To Let Landlords

Discover how portfolio landlords can leverage guaranteed rent schemes to achieve hassle-free property management, secure rental income, and actively contribute to addressing the housing crisis by partnering with local councils.

How to Reduce Your Buy To Let Property Tax Bill

Being a landlord in the UK offers significant opportunities for profit. Learn actionable strategies to reduce your rental property tax bill and maximize your earnings effectively and legally.

The Top Pros and Cons of Being a Self-Managed Landlord

Buy-to-let property investment can be a lucrative way to create a regular income, whether it’s to top up an existing salary or pension, or to act as a main source of revenue. But if you are considering becoming a buy-to-let landlord, the question is, should you go self-managed, or hand over to a property management service to handle everything for you? To make that decision, it’s important to know the pros and cons involved in being a self-managed landlord.