Navigating Tenant Rights in the Face of Rent Increases

In the current rental market, tenants face rising costs due to inflation (higher landlords costs) and high demand, with specific legal protections depending on their tenancy type. Tenants can negotiate with landlords or legally challenge unjust rent increases, particularly through tribunals that assess the fairness of the proposed rent in relation to local market rates. Understanding their rights and the specifics of their rental agreements is key for tenants to navigate these increases effectively.

Navigating Tenant Rights in the Face of Rent Increases

In recent times, the landscape of private rental prices has undergone a dramatic shift, leading to unprecedented challenges for tenants. This article delves into the intricacies of tenant rights, especially in the context of rent hikes initiated by landlords. We’ll explore the legal frameworks, tenant options, and practical advice for those facing increased rental costs.

Understanding the Surge in Rental Prices

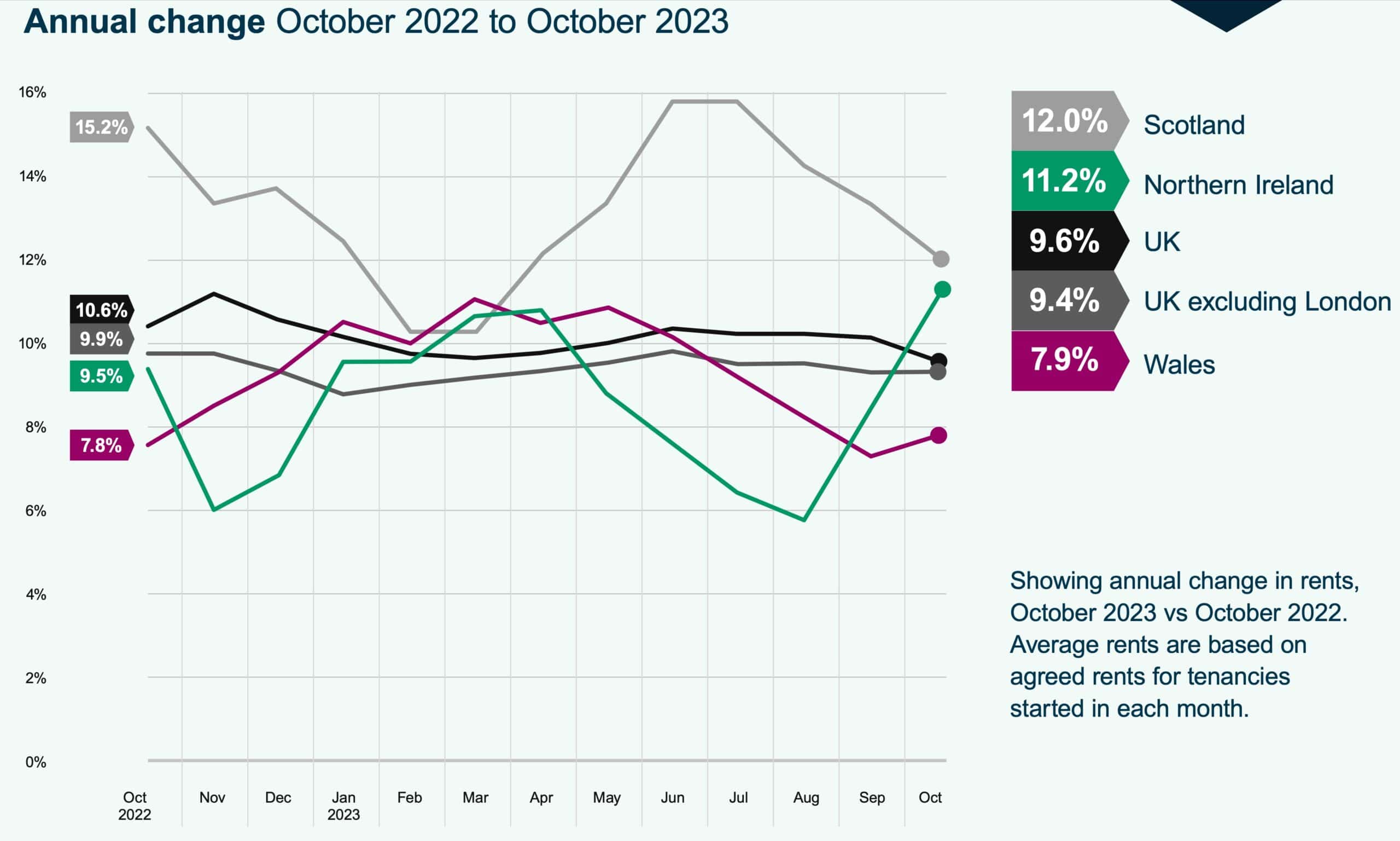

The post-pandemic era has witnessed a significant escalation in rental costs. Record-breaking increases, particularly in metropolitan areas like London, have placed a substantial financial burden on tenants. This surge can be attributed to a combination of inflationary pressures and heightened demand for rental properties, amidst a constricted supply. Such market dynamics have inevitably led to landlords passing on the financial impact to tenants through raised rents.

Tenant Rights and Rent Increase Regulations

The legality of rent increases hinges on the type of tenancy agreement in place. Tenants on a periodic tenancy – a rolling contract with no fixed end date – are generally subject to a maximum of one rent increase per year, barring mutual consent for additional hikes. Conversely, those on fixed-term contracts, typically spanning six to twelve months, are safeguarded against mid-term rent increases unless a mutually agreed rent-review clause is embedded in the contract. This clause must clearly outline the terms, including the notice period and the calculation methodology.

Challenging Unjust Rent Increases

Tenants suspecting unfair rent hikes have recourse to several options. Initially, a direct dialogue with the landlord might resolve the issue amicably, as landlords often prefer retaining reliable tenants. If the increase is formalized through a section 13 notice, tenants can contest it, particularly if the landlord fails to maintain the property adequately, or if the notice itself is procedurally flawed.

The Tribunal Route: A Path to Fair Rent Assessment

Should a landlord-tenant negotiation reach an impasse, tenants can escalate the matter to a tribunal for an impartial review. This process involves examining whether the proposed rent aligns with local market rates and considering what the property might fetch if leased anew. The tribunal’s verdict, while potentially leading to an approved increase, more often than not, results in a favorable outcome for the tenant.

Preparation for Tribunal Hearings

In preparation for a tribunal hearing, tenants should accumulate robust evidence to support their case. This evidence can include documentation of self-funded home improvements, a rationale for considering the rent unfair, and comparative rental prices for similar local properties. Consulting with a local estate agent can provide valuable insights into prevailing market rates.

Final Considerations and Beyond

As tenants navigate these challenging waters, it’s crucial to stay informed and proactive. Understanding one’s rights, the nuances of their tenancy agreement, and the avenues available for dispute resolution can empower tenants in their interactions with landlords. Furthermore, staying abreast of legislative changes and seeking professional advice when necessary can provide additional layers of protection and clarity in these often complex situations.

In conclusion, while the landscape of private rentals continues to evolve, tenants are not without recourse when faced with unjust rent increases. By understanding their rights, exploring negotiation avenues, and utilizing legal mechanisms like tribunals, tenants can effectively advocate for fair and reasonable rental terms.

Homes2let offers a property management service that reduces the landlord burden, with an added benefit…

As a landlord, you have enough to deal with without having deal with deposit claims. So why not hand over to a property management service, but one with a clear added benefit?

The homes2let guaranteed rent scheme guarantees rental payments, even when the property is untenanted, as well as taking all the hassle of property management off your shoulders too.

Interested to discover more? You are welcome to get in touch with our expert team to discover how we can make your life as a landlord more of a breeze.

Riz is the founder of homes2let and has been in real estate for over twenty years. He has a background in economics and is a real estate developer and buy to let investor.

Free, no obligation 15min call with Riz – Book Now

Related Insights

Breathing Space: Debt Respite Scheme to Prevent Landlords From Chasing Unpaid Rent

From 4th of May 2021, a new government scheme will come into force that will give anyone with a problem debt a legal right to protection from creditors. This includes tenants who are in rent arrears with a debt owed to their landlords. The ‘Breathing Space’ arrangement, otherwise known as the Debt Respite Scheme, will allow debtors time to find a solution to their financial issues.

Important things to Consider When Renting to Families with Children

For landlords, families often make attractive tenants, with their preference for long term lets. If you are thinking about renting to families with children, there will be various considerations to make, not least whether your property is suitable. Read on as we explore how to establish whether a property is right for family rentals, and other things to contemplate when letting to families with children.

Surge in Rent Arrears Sparks Call for Landlords to Protect Their Investments

UK landlords are being prompted to make sure they have appropriate strategies in place to protect their property investments following a recent surge in rent arrear cases. With government data revealing that rent arrears amongst private tenants have increased, and almost two thirds of landlords reporting that they’ve had to absorb arrears-related losses from their savings, it is vital that some form of landlord rent arrears insurance is in place to mitigate future financial issues.