The Pros and Cons of Fixing Mortgage Products for Buy-To-Let Investors

Fixing your mortgage interest rate can provide financial stability and predictability, it can also limit your flexibility as a buy-to-let landlord. It is important to weigh up the pros and cons and consider your personal circumstances before making a final decision. Seeking professional advice can help you make an informed choice about what is best for you and your portfolio.

The Pros of Fixing Your Mortgage Interest Rate

Stable Monthly Payments

For buy-to-let landlords, managing a property portfolio can be financially challenging. One of the significant financial commitments is the mortgage payment, which can vary based on interest rate fluctuations. This makes it essential to consider the pros and cons of fixing the mortgage interest rate.

Fixing the mortgage interest rate can provide buy-to-let landlords with stable monthly payments, which makes financial planning and budgeting more manageable. With a fixed interest rate, the mortgage payments remain constant throughout the fixed term, regardless of market fluctuations or interest rate changes. This stability can help landlords plan better and manage cash flow, knowing precisely how much money will be going out each month.

Protection Against Interest Rate Hikes

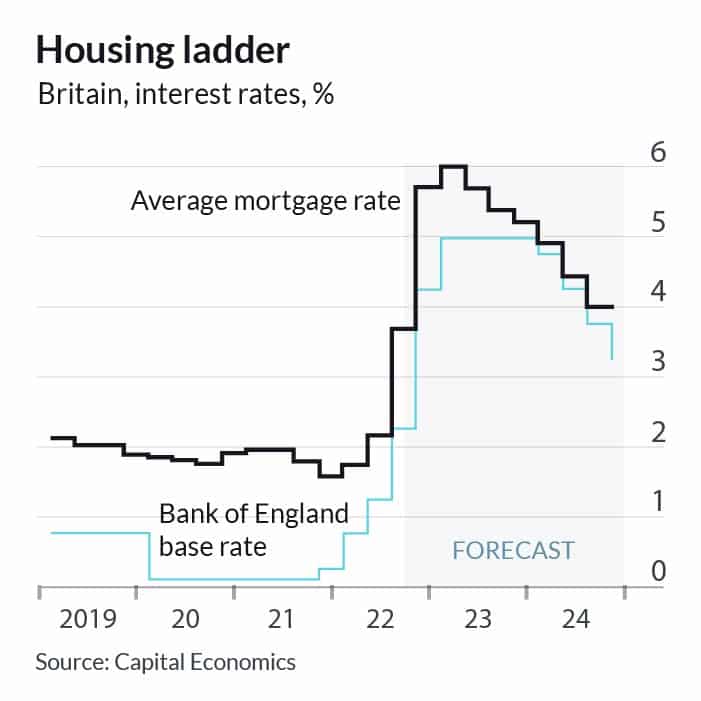

In addition to the stability of fixed payments, fixing the mortgage interest rate can also provide protection against potential interest rate hikes in the future. This can be especially important in times of economic uncertainty or market volatility, where interest rates are likely to fluctuate.

Certainty in Long-Term Planning

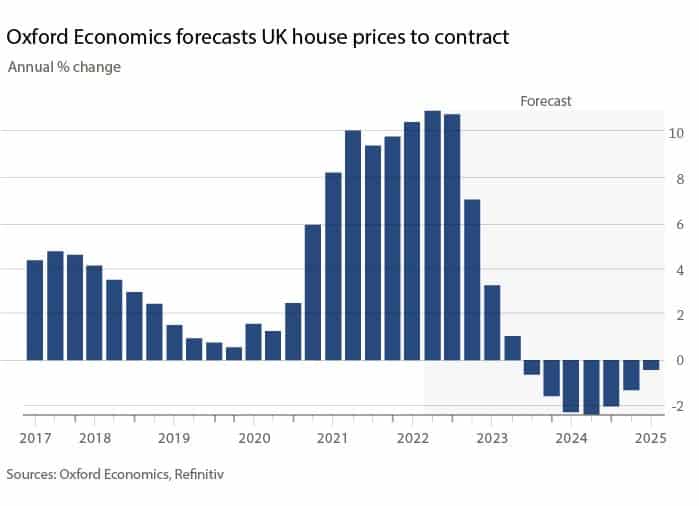

While there are downsides to fixing the mortgage interest rate, such as less flexibility, higher initial costs, and the risk of missed opportunities, the stability of fixed payments can be a significant benefit for buy-to-let landlords. This stability provides landlords with the confidence to plan for the future and make investment decisions that align with their long-term strategy.

In conclusion, if you are a buy-to-let landlord, fixing your mortgage interest rate can provide you with the financial stability and predictability you need to manage your portfolio effectively. It is essential to consider all your options and seek professional advice before making a final decision.

“The homes2let guaranteed rent option has many similarities to fixed rate mortgage products in so much that we ensure you have a fixed income for a set duration of time. If in case the tenant’s financial circumstances worsen, the property becomes vacant your monthly rent is still guaranteed for the duration of the contract.”

The Cons of Fixing Your Mortgage Interest Rate

Less Flexibility in Repayment Options

When you fix your mortgage interest rate, you commit to making the same repayments for a set period. This means that you may be limited in the repayment options that you have available to you. If you have additional income or are expecting a lump sum payment, you may not be able to make overpayments or pay off your mortgage early without incurring penalties.

Less Flexibility in the Market

Fixing your mortgage interest rate also limits your flexibility in the market. You may miss out on a better deal that becomes available during the fixed period. If the market interest rates drop, you will still be locked into your current rate, which may no longer be as competitive.

Risk of Missing Opportunities

Finally, fixing your mortgage interest rate can be a disadvantage because it prevents you from taking advantage of market opportunities. If the market is volatile and unpredictable, it may be advantageous to keep your options open and have the flexibility to move with the market. Fixing your mortgage interest rate could mean that you miss out on these opportunities.

In conclusion, while fixing your mortgage interest rate can provide financial stability and predictability, it can also limit your flexibility as a buy-to-let landlord. It is important to weigh up the pros and cons and consider your personal circumstances before making a final decision. Seeking professional advice can help you make an informed choice about what is best for you and your portfolio.

Conclusion

Ultimately, the decision of whether to fix your mortgage interest rate depends on your individual circumstances and investment strategy. If you value stability and certainty in your financial planning, a fixed-rate mortgage may be the right choice for you. However, if you value flexibility and want to take advantage of potential savings in the future, a variable-rate mortgage may be the better option.

As with any financial decision, it is essential to seek professional advice and consider all your options before making a final decision.

“Fixed mortgage payments are often compared to insurance policies, they give you cerainty and hedge against the risk of crisis in case of house price deflation and interest rates rising. Its always wise to seek advice from a financial advisor and mortgage broker but many 5 year fixed products are similary priced if not cheaper than some discounted products.

Being able to budget and accurately predict your month cash flow forecast is of paramount importance to many households and investors. The homes2let rent gurantee option offers a guranted income for a specified period of time and rent is even paid if the property is vacant or if the occupants financial position worsens. With no agency costs to pay, and largely a hands off service its often the safest and predictable way to maximise profits for BTL Landlords.”

Homes2let offers a property management service that reduces the landlord burden, with an added benefit…

As a landlord, you have enough to deal with without having deal with deposit claims. So why not hand over to a property management service, but one with a clear added benefit?

The homes2let guaranteed rent scheme guarantees rental payments, even when the property is untenanted, as well as taking all the hassle of property management off your shoulders too.

Interested to discover more? You are welcome to get in touch with our expert team to discover how we can make your life as a landlord more of a breeze.

Riz is the founder of homes2let and has been in real estate for over twenty years. He has a background in economics and is a real estate developer and buy to let investor.

Free, no obligation 15min call with Riz – Book Now

Related Insights

Navigating Tenant Rights in the Face of Rent Increases

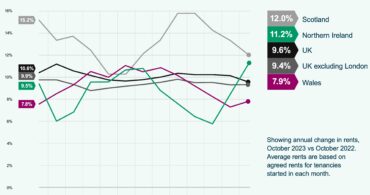

In the current rental market, tenants face rising costs due to inflation (higher landlords costs) and high demand, with specific legal protections depending on their tenancy type. Tenants can negotiate with landlords or legally challenge unjust rent increases, particularly through tribunals that assess the fairness of the proposed rent in relation to local market rates. Understanding their rights and the specifics of their rental agreements is key for tenants to navigate these increases effectively.

A Comprehensive Guide to Buying a House to Let

Buying a house to rent out can be a profitable investment with a strategic plan. This guide covers essential steps: planning your strategy, marketing, property management, and legal compliance. Learn to identify target tenants, choose the right location, and maximise rental income while minimising risks.

Property Value Growth in England Spells Good News for Buy to Let Investors

The values of homes across England have increased by 80 per cent in the past decade. The rental market specifically has grown 105 per cent to represent a staggering value of £1.5 trillion, with £529 billion of that in London alone. With growth like this in the rental sector, it would seem those investing in buy to let property are set to win hands down.